Whatever phase your business is in, we offer flexible loans to meet your goals.

Our Guaranteed Government Lending team has extensive experience navigating the lending process. Our team provides expert assistance in working with SBA, FSA, and USDA loans to guide you to the optimal program(s) that meets your goals and your business needs.

Key Features

-

![]() Competitive Terms

Competitive Terms

-

![]() Unique Benefits

Unique Benefits

-

![]() Experienced SBA Lenders

Experienced SBA Lenders

How can the SBA help you?

Together, we'll put together a loan structure that works for your business, whatever the purpose. SBA 7[a] loans are a great fit for a variety of financing needs, such as:

- Business Acquisition or Partner Buy-out

- Commercial Real Estate Purchase or Refinance - up to 90% financing available

- New Construction and Renovations - up to 90% financing available

- Refinance Business Debt

- Proceeds can include working capital, inventory, franchise fees, soft costs and closing costs

The SBA 7[a] Loan program was designed to help you get the working capital you need to start, acquire, or expand your small business. Take advantage of lower down payment options, longer repayment terms, and more flexibility to drive your business forward.

SBA 7[a] Loan Features

- Longer terms for cash flow enhancement

- Low down payment requirements

- Increased liquidity for next opportunity

- Streamlined underwriting and closing process

- Loan terms up to 25 years for real-estate financing

- Loan terms up to 10 years for non real-estate

The eligibility requirements for a 504 loan are almost the same as for the 7(a) loan program, but the uses of the loan are different. The 504 loan can be used for a range of assets that promote business growth and job creation. These include the purchase or construction of:

- Existing buildings or land

- New facilities

- Long-term machinery and equipment

Since we opened our doors in 1893, we've been helping our local farmers succeed - and that continues to this day.

Key Features:

- Competitive Rates

- Customized Terms

- Local Decisions

Details:

- Competitive rates for a wide range of agriculture expenses:

- Livestock

- Crops

- Equipment

- Land acquisition

- And more

- Accommodating financing terms, customized to your operation's unique situation

- Local, Blue Ridge decision-making and processing

- Thorough, attentive service every step of the process

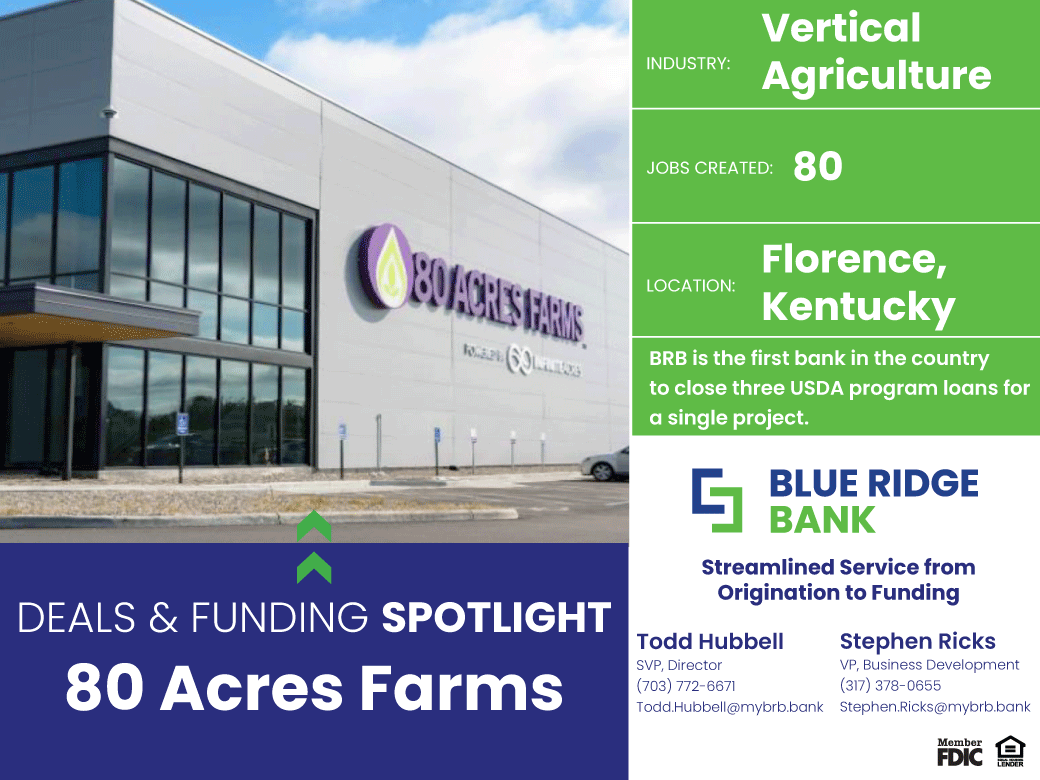

USDA Business & Industry Program

The B&I loan guarantee program is designed to help credit-worthy rural businesses obtain financing. The intent is to save and create jobs in rural America. If your business or project is in an eligible rural or suburban area, then you may be eligible for USDA financing.

USDA Community Facilities Program

The REAP program provides grant funding and guaranteed loan financing to agricultural producers, along with rural small businesses for renewable energy systems or to make energy efficiency improvements. Agricultural producers may also apply for new energy efficient equipment and new system loans for agricultural production and processing.

Use this calculator to determine your projected earnings from our Kasasa Cash account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly interest earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total interest earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Business Money Market

| Balance | Rate | APY* |

|---|---|---|

| $0.00 - $2,499.99 | 0.00% | 0.00% |

| $2,500.00 - $4,999.99 | 0.05% | 0.05% |

| $5,000.00 - $24,999.99 | 0.10% | 0.10% |

| $25,000.00 - $99,999.99 | 0.35% | 0.35% |

| $100,000.00 - $999,999.99 | 0.50% | 0.50% |

| $1,000,000.00 and Greater | 0.65% | 0.65% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Minimum balance to open and to obtain APY is $2,500. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Business Savings

| Product | Interest Rate | APY* |

|---|---|---|

| Business Savings | 0.10% | 0.10% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Minimum balance to open and to obtain APY is $100. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Business with Interest

| Balance | Rate |

|---|---|

| $3,000.00 | 0.10% |

*Rate accurate and effective as of 1/1/2025. This rate(s) is subject to change. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Certificate of Deposit Specials

| Term | Interest Rate | APY | Minimum Balance |

|---|---|---|---|

| 5 Months | 4.15% | 4.20% | $1,000 |

| 10 Months | 3.84% | 3.90% | $1,000 |

| 15 Months | 3.80% | 3.85% | $1,000 |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This is a limited time offer and may be withdrawn at any time. Minimum balance to open and to obtain APY is $1,000. Certain restrictions and conditions may apply. Fees may reduce earnings. Early withdrawal fee may apply. All figures in examples are for product explanation and are based on a 5-month and 10-month term. Ask us for complete details.

Certificates of Deposit

| Term | Rate | APY* | Minimum Balance |

|---|---|---|---|

| 3 - 5 Months | 1.00% | 1.00% | $1,000 |

| 6 Month | 1.05% | 1.05% | $1,000 |

| 7 - 11 Months | 1.10% | 1.10% | $1,000 |

| 12 - 17 Months | 1.24% | 1.25% | $1,000 |

| 18 - 23 Months | 1.29% | 1.30% | $1,000 |

| 24 - 35 Months | 1.34% | 1.35% | $1,000 |

| 36 - 47 Months | 1.39% | 1.40% | $1,000 |

| 48 - 59 Months | 1.44% | 1.45% | $1,000 |

| 60 Months and Longer | 1.49% | 1.50% | $1,000 |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Minimum balance to open and to obtain APY is $1,000. Certain restrictions and conditions may apply. Fees may reduce earnings. Early withdrawal fee may apply. Ask us for complete details.

Charitable Checking

| Product | Interest Rate | APY* |

|---|---|---|

| Charitable Account | 0.10% | 0.10% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Minimum balance to open and to obtain APY is $500. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Golden Advantage Certificate of Deposits and Specials

| Term | Interest Rate | APY | Minimum Balance |

| 12 months | 3.94% | 4.00% | $1,000 |

| 30 months | 1.34% | 1.35% | $1,000 |

| 36 months | 1.39% | 1.40% | $1,000 |

| 60 months | 1.49% | 1.50% | $1,000 |

**Annual Percentage Yield (APY) accurate and effective as of 1/1/25. This is a limited time offer and may be withdrawn at any time. Minimum balance to open and to obtain APY is $1,000. Certain restrictions and conditions may apply. Fees may reduce earnings. Early withdrawal fee may apply. All figures in examples are for product explanation and are based on a 12-month, 30-month, and 60-month term. Ask us for complete details.

Golden Advantage Money Market

| Product | Interest Rate | APY |

|---|---|---|

| Golden Advantage Money Market | 0.50% | 0.05% |

Golden Advantage Plus Checking

| Balance | Interest Rate | APY* |

|---|---|---|

| $0.00 - $2,499.99 | 0.025% | 0.030% |

| $2,500.00 - $24,999.99 | 0.050% | 0.050% |

| $25,000.00 - $49,999.99 | 0.050% | 0.050% |

| $50,000.00 and Greater | 0.075% | 0.076% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate(s) is subject to change. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Health Savings

| Product | Interest Rate | APY* |

|---|---|---|

| Health Savings Account | 0.15% | 0.15% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Minimum balance to open and to obtain APY is $100. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Jumbo Certificates of Deposit

| Term | Rate | APY* | Minimum Balance |

|---|---|---|---|

| 1 - 2 Months | 1.00% | 1.00% | $100,000 |

| 3 - 5 Months | 1.09% | 1.10% | $100,000 |

| 6 Months | 1.15% | 1.15% | $100,000 |

| 7 - 11 Months | 1.19% | 1.20% | $100,000 |

| 12 Months and Longer | 1.34% | 1.35% | $100,000 |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Minimum balance to open and to obtain APY is $100,000. Certain restrictions and conditions may apply. Fees may reduce earnings. Early withdrawal fee may apply. Ask us for complete details.

Kasasa Cash*

| Balance | Minimum Deposit to Open | Interest Rate | APY* |

|---|---|---|---|

| $100 - $15,000 | $100 | 4.89% | 5.00% |

| $15,000+ | NA | 0.05% | 0.05% |

| All balances if qualifications not met | NA | 0.01% | 0.01% |

*APY=Annual Percentage Yield. APYs accurate as of 7/1/2024. Rates may change after account is opened. For Kasasa Cash, if qualifications are met each monthly qualification cycle: (1) Domestic ATM fees incurred during qualification cycle will be reimbursed up to $25 and credited to account on the last day of monthly statement cycle; (2) balances up to $15,000 receive APY of 5.00%; and (3) balances over $15,000 earn 0.05% interest rate on the portion of the balance over $15,000. If qualifications are not met on Kasasa Cash, all balances earn 0.01% APY. Qualifying transactions must post and settle to Kasasa Cash account during monthly qualification cycle. Transactions may take one or more banking days from the date transaction was made to post and settle to account. ATM-processed transactions do not count towards qualifying debit card transactions. "Monthly Qualification Cycle" means a period beginning one day prior to the first day of the current statement cycle through one day prior to the close of the current statement cycle. The advertised Kasasa Cash APY is based on compounding interest. Interest earned in Kasasa Cash is automatically transferred to Kasasa Saver each statement cycle and does not compound. Actual interest amount paid may be less than advertised Kasasa Cash APY. The Kasasa Saver APYs may be less than Kasasa Cash APYs. Transfers between accounts do not count as qualifying transactions. ATM receipt must be presented for reimbursement of an individual ATM fee of $5.00 or higher.

Qualifications

Enrollments must be in place and all of the following transactions and activities must post and settle to your Kasasa Cash® account during each Monthly Qualification Cycle:

- Have at least 10 debit card purchases post and settle

- Be enrolled and receive eStatement notice

- Have at least 1 direct deposit or 1 ACH auto debit post and settle

That's it. Even if you don't meet your qualifications during the cycle, you will still earn our base interest rate. And you can get right back to earning your full rewards the very next month.

Kasasa Saver*

| Balance | Minimum Deposit to Open | Interest Rate | APY* |

|---|---|---|---|

| $0 - $100,000 | $0 | 2.96% | 3.00% |

| $100,000+ | $0 | 0.05% | 0.05% |

| All balances if qualifications not met | $0 | 0.01% | 0.01% |

*APY=Annual Percentage Yield. APYs accurate as of 7/01/2024. Rates may change after account is opened. Qualifying transactions must post and settle to Kasasa Cash account during monthly qualification cycle. Transactions may take one or more banking days from the date transaction was made to post and settle to account. ATM-processed transactions do not count towards qualifying debit card transactions. "Monthly Qualification Cycle" means a period beginning one day prior to the first day of the current statement cycle through one day prior to the close of the current statement cycle. The advertised Kasasa Cash APY is based on compounding interest. Interest earned in Kasasa Cash is automatically transferred to Kasasa Saver each statement cycle and does not compound. Actual interest amount paid may be less than advertised Kasasa Cash APY. The Kasasa Saver APYs may be less than Kasasa Cash APYs. If qualifications in Kasasa Cash are met each monthly qualification cycle: (1) balances up to $100,000 in Kasasa Saver receive an APY of 3.00%; and (2) balances over $100,000 in Kasasa Saver earn 0.05% interest rate on portion of balance over $100,000, resulting in 0.05% APY depending on the balance. If qualifications are not met on Kasasa Cash, all balances in Kasasa Saver earn 0.01% APY. Transfers between accounts do not count as qualifying transactions. ATM receipt must be presented for reimbursement of an individual ATM fee of $5.00 or higher.

Qualifications

Qualifying for your Kasasa Cash rewards automatically qualifies you for the highest Kasasa Saver® rate, too. Enrollments must be in place and all of the following transactions and activities must post and settle to your Kasasa Cash account during each Monthly Qualification Cycle:

- Have at least 10 debit card purchases post and settle

- Be enrolled and receive eStatement notice

- Have at least 1 direct deposit or 1 ACH auto debit post and settle

That's it. Even if you don't meet your qualifications during the cycle, you will still earn our base rate. You can get right back to earning your full rewards the very next month.

MD IOLTA

| Average Daily Balance | APY* |

|---|---|

| $5,000 | 3.30% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate(s) is subject to change. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Money Market Tiered

| Balance | Rate | APY* |

|---|---|---|

| $0.00 - $24,999.99 | 0.25% | 0.25% |

| $25,000.00 - $49,999.99 | 0.35% | 0.35% |

| $50,000.00 - $249,999.99 | 0.50% | 0.50% |

| $250,000.00 and Greater | 0.65% | 0.65% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Municipal Money Market

| Balance | Rate | APY* |

|---|---|---|

| $1,000.00 and Greater | 0.15% | 0.15% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Minimum balance to open and to obtain APY is $1,000. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

NC IOLTA

| Minimum Balance | APY* |

|---|---|

| n/a | 3.30% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate(s) is subject to change. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Personal Savings

| Product | Interest Rate | APY* |

|---|---|---|

| Personal Savings | 0.10% | 0.10% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Minimum balance to open and to obtain APY is $100. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Platinum Money Market

| Balance | Rate | APY* |

|---|---|---|

| $0.00 - $24,999.99 | 0.00% | 0.00% |

| $25,000.00 - $49,999.99 | 3.15% | 3.20% |

| $50,000.00 - $249,999.99 | 3.15% | 3.20% |

| $250,000.00 and Greater | 3.15% | 3.20% |

*Annual Percentage Yield (APY) accurate and effective as of 11/19/24. The minimum balance to obtain interest on the Platinum Money Market is $25,000. An $11 service fee applies if the account balance falls below the minimum balance. This offer is for new money not currently on deposit with Blue Ridge Bank.

Signature Money Market*

| Balance | Rate | APY* |

|---|---|---|

| $0.00 - $24,999.99 | 0.00% | 0.00% |

| $25,000.00 - $49,999.99 | 0.00% | 0.00% |

| $50,000.00 - $249,999.99 | 3.88% | 3.95% |

| $250,000.00 and Greater | 3.88% | 3.95% |

*Annual Percentage Yield (APY) accurate and effective as of 9/30/24. The minimum balance to obtain interest on the Signature Money Market is $50,000. An $11 service fee applies if the account balance falls below the minimum balance. This offer is for new money not currently on deposit with Blue Ridge Bank.

VA IOLTA

| Balance | APY* |

|---|---|

| $0.00 - $50,000.99 | 0.10% |

| $50,001.00 and Greater | 0.20% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.

Youth Savings

| Product | Interest Rate | APY* |

|---|---|---|

| Youth Savings | 0.10% | 0.10% |

*Annual Percentage Yield (APY) accurate and effective as of 1/1/2025. This rate is subject to change. Minimum balance to open and to obtain APY is $10. Certain restrictions and conditions may apply. Fees may reduce earnings. Ask us for complete details.